Transform the health industry

tl;dr: U.S. should enact Medicare for All in the Australian model

Let’s face reality

The United States is a terrible place to fall ill or have an injury, largely because of how deeply our healthcare delivery system is tied up with an excessively for-profit health insurance system. No other country in the world bankrupts people who have the misfortune to need extensive medical care. No other country spends as much on its healthcare system, and no other developed country sees such poor outcomes despite all that expenditure.

Like many Americans, I watched the news unfold this past week around the assassination of United Healthcare’s CEO with genuine horror, mixed with a reluctant understanding. To be clear: I do not and never will condone murdering people to make a point. Our rage at injustice ought to be pointed at the system itself so that we can drive meaningful and lasting change.

We Americans know too well how thoroughly the practice of healthcare is dominated by the decisions of health insurance companies seeking to maximize shareholder profits. We have experienced our friends, family, self, and neighbors suffer — yes, even die1! — because of arcane and inhumane decisions around how care is obtained, what procedures are covered by insurance, and how medical claims are paid.

Be aware, I’m a healthtech insider

I intentionally have worked primarily in the healthtech domain for over 20 years. My first professional experiences were at St. Jude Medical, the Fortune 500 medical device company (when mentioning it, I always have to say: “Not the children’s research hospital!”). There, my career became aligned with my desire to help make the world a better place. The innovative products we created helped nurses, cardiologists, and electrophysiologists deliver better care experiences for people with implantable pacemakers and defibrillators. My career since then has included consulting clients and full-time employers at healthtech startups, scaleups — and giant industry players, most notably Cigna.

Working inside Cigna, one of the health insurance behemoths operating in America, was eye-opening — but not in the way you might imagine! Initially leery and only involved in a consultative capacity, I thought of myself as a white blood cell, moving through the corridors of power and spreading my user-centered design insights and innovative product management methods to fight malignancy and create healthy antibodies. As time went on, I saw a company full of dedicated, sincere, well-meaning individuals working to better Cigna customers’ health2. Cigna employs thousands of nurses, behaviorists, and other clinicians who genuinely seek to improve people’s health. Across the board, every piece of technology I was involved in building sought to improve Cigna customers’ health outcomes and increase their engagement with personalized, useful clinical solutions.3

As I and others have recognized, healthcare consumers and health insurance companies have aligned goals at the most basic level: let’s have everybody be as well as possible. The core problem with the American system, though, lies in the fact that our health insurance companies are excessively for-profit entities that must nevertheless cover the entire American population. Their inherent intent to maximize people’s general wellness is hampered by their capitalist entity’s need to control costs and drive revenue. Essentially, these entities are left to manage a “sick care system” that has produced no winners besides corporate executives and shareholders.

A better model exists in Australia

I believe that Australia’s flavor of a “Medicare for All” model is one that America could adopt to cut the Gordian knot of our health insurance industrial complex.

In Australia, every citizen and permanent resident is covered by Medicare, a government-run, “single-payer” insurance program. (Yes, they call it the same thing as we call the Unites States’ federal single-payer system, which Americans can only become eligible for when they reach 65 years of age, or if they have a permanent disability.) This national plan handles costs for Australian healthcare consumers through a combination of free and subsidized services. While it’s not a total panacea on its own, no Australian goes bankrupt due to medical expenses. Every Australian can easily and reliably access high-quality healthcare options intended to cure, treat, or heal their illnesses and injuries.

Between 2016 and 2017, I had the good fortune to live in Australia, leading product for a health insurance startup under the Qantas umbrella. Anecdotally at least, my husband had several encounters with their healthcare system that exhibited ease-of-use and excellent care.

Now here’s what’s so interesting and applicable: the Australian government also levies a tax on each taxpayer IF that individual does not purchase a PRIVATE health insurance plan. The tax is about 2% of one’s income, creating a powerful incentive for people to acquire a private health insurance plan, since many available plans cost far less annually than 2% of one’s income. These private health insurance plans primarily offer coverage options around hospital stays and surgeries, use of ambulances, and general health services such as dental, vision, and physical therapy. Private health insurance companies are prohibited from denying coverage to any applicant and must charge everybody the same price for a given set of benefits.

As a result of this Medicare levy, Australia enjoys a thriving private health insurance industry that does not engender fury and hatred amongst its customers. Crucially, most health insurance companies there — including the several largest — are NOT-for-profit entities. (Remember: a not-for-profit entity can totally generate profits — they just have to reinvest those profits back into the business rather than using it for other purposes, like shareholder dividends or diversification, etc.)

So, this tax levy incentivizing consumers to acquire additional coverage has created a wide range of healthtech businesses, each creating a tailored package of healthcare benefits intended to appeal to different audiences. Many cater their health benefits toward different demographics, like teachers or single parents or fitness nuts. Innovative plans and meaningful benefits emerge as a consequence. For example, our solutions at Qantas centered around the Wellbeing App that incentivized healthy behaviors by awarding members with Qantas Frequent Flier points (essentially a second functional currency in Oz).

And let me not neglect to mention happy health outcomes from the Australian system! Australians enjoy one of the highest life expectancies globally, and the country performs well on key health metrics such as infant mortality and preventable deaths. Being an integrated system, providers can deliver more comprehensive and appropriate care to patients, and the system conducts robust data collection that supports ongoing, evidence-based policymaking and improvements. It’s cost-efficient and transparent, and well-regarded from an inclusion and accessibility standpoint since their system better supports the most vulnerable populations. What’s not to love?

Unleash innovation and reduce waste

This Australian brand of a Medicare for All solution is well fit for purpose in the United States.4 The main transformation in the States involves providing universal healthcare coverage through an expansion of the government-run Medicare program. No American will die because of a lack of coverage. Nobody will lose their car, house, or life savings to pay medical bills. Provider groups will have fewer headaches and less overhead.

Crucially, with the introduction of a single-payer solution for all, America’s existing health insurance companies would have to adapt to operating as a supplemental policy. This shift would create tremendous pressure on these companies to improve their behavior and streamline bloated operations.

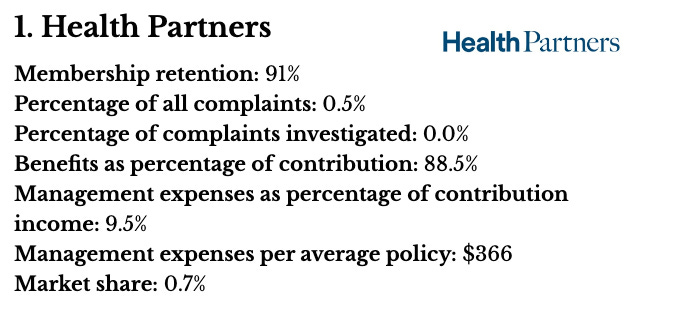

Take for example how this magazine5 presents Australian healthcare consumers with insights on their options, such as this firm that was ranked #1 because of its high membership retention:

When “membership retention” is a meaningful metric because consumers can vote with their feet, individuals become empowered. Hate UHC’s rates of denials and deferrals? Buy a policy elsewhere!

The Australian model creates genuine competition and introduces better incentives for creating innovative and, most of all, effective services by and for the entities that comprise our healthcare ecosystem.

America is filled with so much talent, especially in terms of practicing healthcare providers and healthtech professionals who envision better solutions. Right now, just about everybody is stifled by this increasingly fraught and broken system, from clinicians to consumers to the entrepreneurs who want to lead us out of this morass. Enacting bold reforms by providing Medicare for All and creating a tax levy incentivizing supplemental private health insurance would unleash a torrent of innovation even as it would help scrape away our current system’s hideously high administrative expenses.

Is there a better time or place to discuss this urgent matter than here and now? There is so much to discuss6 — please share your thoughts and feelings!

Lizz at Devise is a publication exploring the space of design and product management through the lens of heart-centered values and teamwork. Lizz is also deeply passionate about healthtech, with the positive intent to help make the world a better place. Her firm Devise Consulting is presently mostly booked up, but she remains happy to discuss potential engagements, especially in advising and mentoring. Also, since this publication will take a break through the end of the year: wishing you all the opportunity for a joyous end of 2024 and a wonderful start to the new year!

https://pmc.ncbi.nlm.nih.gov/articles/PMC2323087/#:~:text=More%20than%2026%20000%20Americans,lack%20of%20health%20insurance%20%2D%20PMC&text=A%20.gov%20website%20belongs%20to,organization%20in%20the%20United%20States and https://news.harvard.edu/gazette/story/2009/09/new-study-finds-45000-deaths-annually-linked-to-lack-of-health-coverage/

Probably worth mentioning that I never interacted directly with the departments that were in charge of defining plan benefits and managing claims. I worked on a relatively maverick technology team, creating digital solutions in support of clinical programs.

One thing people often mention as a negative about health insurance companies is that they’re unwilling to invest in wellness because of the propensity of healthcare consumers to switch between insurance providers. The potential argument goes: since consumers aren’t loyal or long-term to any one insurance company, why would Insurance Company A invest in an individual’s wellness when Insurance Company B would later reap the rewards of having a healthier customer? By the time I joined Cigna, however, this viewpoint wasn’t in evidence. After all, that customer who shifted to Insurance Company B could just as easily return to Insurance Company A down the line. People on the inside had recognized that investing in consumers’ health & wellness would benefit the entire system: we practiced “a rising tide lifts all boats” mentality.

Wanted to add that Germany’s health insurance model is often cited as a viable one for America, as well. As in Australia, the German system provides for universal health care, but utilizing a combination of a statutory health insurance (run not by the government, however, but by nongovernmental insurers known as sickness funds) along with private health insurance options that are only available to German citizens earning more than $68,000/year who are allowed to opt out of the statutory insurance. While highly functional and light years better than what America has today, I believe America would have a more difficult transition from today’s reality into the German model compared to the Australian one, since the States already has a government single-payer system to leverage.

https://www.insurancebusinessmag.com/au/guides/10-top-private-health-insurance-companies-in-australia-440974.aspx

While I am focused here on the health insurance industry problem, I am driven to note how many other systemic problems exist with healthcare in America, including:

the explosion of middle-management organizations, such as Pharmacy Benefits Administrators, handling critical interstitial elements of the healthcare system entirely for a profit motive

the excruciatingly slow development of interoperability that has prevented patients from truly owning their health data, and from getting accurate cost estimations prior to receiving medical care

the increased influence of those companies whose profit motive is selling drugs to the public

the way that health insurance coverage is so often sourced from one’s employer which reduces people’s job mobility and ability to take entrepreneurial risks

the growing shortage of primary care providers along with the depth of burnout being experienced by so many medical professionals

the various socio-cultural factors that have led to a population health crisis wherein so many people are burdened with cancer and chronic diseases…

And tragically, this list can go on! There are also many barriers facing the enactment of a Medicare for All scheme, yet none of the issues facing such a transformation are so great that they should stop us from mustering the collective action and political willpower to get it done. Who’s with me?

This is a fantastic piece! Very well written and makes a strong argument--thank you for your thoughtful insights!

Hi Lizz!

It's nice to read your thoughts, clearly formulated.

I hope that you will be able to influence the course of events. I wish you good luck in this difficult task.